According to data from the American Association of Health System Pharmacists, as of March 31, there were 323 drug shortages in the United States, breaking the record for drug shortages since the association started counting in 2001; Coincidentally, according to the UK Association of Generic Drug Manufacturers, the shortage of drugs in the UK has doubled in the past two years, with 101 reports of drug supply issues in February 2024 and 52 in February 2022; According to Teva Pharmaceuticals' recent analysis of IQVIA data, the withdrawal rate of generic drugs in Europe has increased by 12% in the past decade, while the market volume of generic drugs has decreased by 3%. Is the trend of the pharmaceutical market in the above-mentioned countries and regions indicating a major global decline in the pharmaceutical industry, or is there a huge business opportunity for insufficient drug supply in developed countries in Europe and America?

As of March 31st, the American Society of Health System Pharmacists (ASHP) has added 48 new drugs to the national shortage tracking. According to a new report by ASHP, the number of active shortages so far will reach 323 by 2024. This is the highest number since the association started counting in 2001.

The number of drug shortages in each quarter of the United States over the past decade

Data source: American Association of Health System Pharmacists

ASHP stated that there is a shortage of essential and emergency medications, with the five most affected drugs being central nervous system, antibiotics, hormones, chemotherapy, and liquid electrolyte drugs. Nearly half of the injection type varieties are in limited supply (46%). Some of these drugs include oxytocin, conventional chemotherapy, pain and sedative drugs, and ADHD drugs.

Pharmacy shelves

Image source: Brendan McDermid Reuters

The ASHP Association stated that the quota changes by the US Drug Enforcement Agency (DEA) have to some extent exacerbated the 12% shortage of drugs. Last August, DEA changed the process for manufacturers to obtain their production volume restrictions or quota allocations. As part of the new process, pharmaceutical companies need to submit an estimated production schedule before obtaining quotas, and now they must apply for quotas quarterly instead of annually.

The report states that in 60% of cases in 2023, pharmaceutical companies were unaware or unable to provide reasons for shortages. The inability to meet demand is the primary cause of shortages, accounting for 14%, while business decision-making and manufacturing each account for 12%. Finally, raw material issues account for 2% of the shortage. Just a week before the release of the new data, the US Department of Health and Human Services released a white paper proposing recommendations for Congress to address this issue. One important suggestion is to develop incentive measures for hospitals to avoid drug shortages.

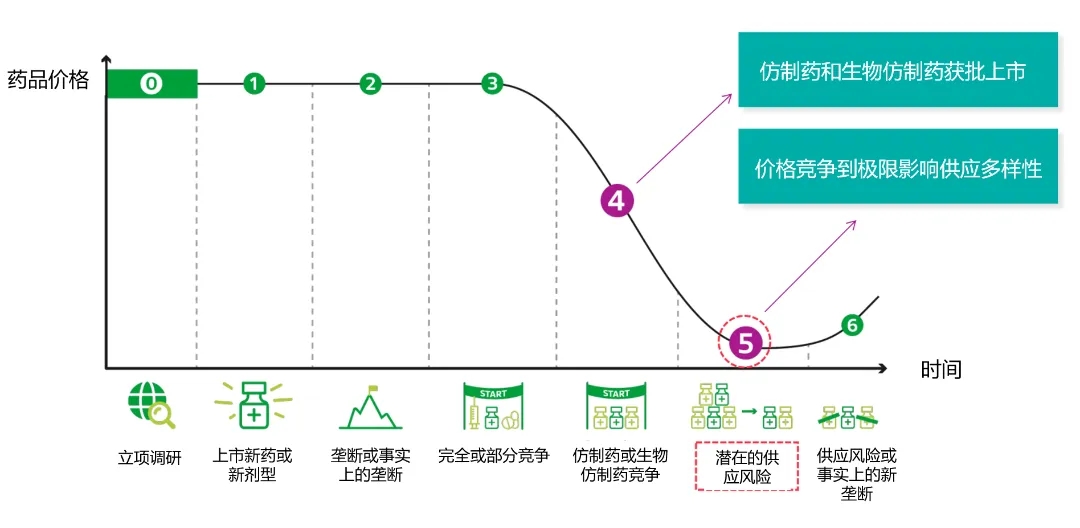

According to Teva Pharmaceuticals' recent analysis of IQVIA data, the withdrawal rate of generic drugs in Europe has increased by 12% in the past decade, while the market volume of generic drugs has decreased by 3%. In the field of psychotherapy, between 2013 and 2023, 7% of generic drugs disappeared, and the supply of cancer generic drugs decreased by 7% in just six years (2017-2022).

These drugs are included in the EU's key drug list to avoid potential shortages causing significant harm to patients and posing significant challenges to the health system. The Tiva analysis report points out that although mature generic drugs make up the majority of the list, they are still easily delisted by manufacturers, despite including products that are crucial for ensuring public health in Europe. Since 2013, the number of generic drugs used for the treatment of schizophrenia and bipolar disorder has decreased by 25%, with Hungary and Bulgaria experiencing the largest declines of 83% and 58%, respectively. Small batch products are also not immune, such as ordinary oral liquids, antibiotics, and pediatric syrups, which are also experiencing a decline.

Teva Europe 2024 data analysis found that 21% of products in this field disappeared between 2013 and 2023. According to the report, the number of generic drugs began to decline only 3-4 years after their launch due to various reasons, such as price competition.

The market performance of generic drugs with expired patents is completely driven by price

Source: Amgros

Despite this, there are also product categories that are growing against the trend, such as the rapid growth of long-acting injection generic drugs, with an 86% increase in the number of generic long-acting injection (LAI) varieties, including cell growth hormone, pituitary hormone, hypothalamus, and antipsychotic drugs. LAI belongs to the category of complex generic drugs, and the difficulty of developing, producing, and obtaining market approval for these generic drugs is high. Although preparations such as generic long-acting injections are growing rapidly, they only account for 1% of all drugs. This research report is not the first time Teva has sounded the alarm about the increasing risk of generic drug shortages. According to its 2023 analysis titled "The Disappearing Drug Cabinet Case in Europe", 69% of generic drugs launched on the market in 2022 had fewer than two suppliers. 26% of generic drugs launched in 2012 are no longer available in the European market. Its previous research also showed that the number of suppliers for a generic drug decreased by 46%.

In the latest study, the supply of generic drugs showed the same trend, falling 49 percent since 2015. In its report, the company highlighted that this worrying trend in the European generics market "has the potential to jeopardise Europe's confidence in supporting its citizens' access to key medicines" in areas defined as health priorities, such as mental health, cancer and even antibiotics.

The UK Generic Manufacturers Association (BGMA) recently warned that the UK could become a "backwater" in the pharmaceutical supply market with a supportive policy environment. In its new manifesto, the BGMA Outlines policy areas where generics and biosimilars - representing four out of five NHS prescriptions - can be optimised.

"Despite the fact that the generic and biosimilar industry matters to the health and well-being of our nation, it has been largely ignored from a policy perspective," said BGMA chief executive Mark Samuels. "The EU-UK Trade and Cooperation agreement undermines the resilience of the UK's medicines supply, adding complexity to the regulation and distribution of medicines in an industry that relies on simplicity to survive." In addition, an unstable government pricing system and significant domestic regulatory delays have made the UK "increasingly unattractive for international companies."

In its statement, the BGMA said: "The net result of these issues has been a doubling in the number of shortages as manufacturers have found the UK to be a commercially unsustainable market for supply." Policies that support the survival and economic growth of this critical industry." In an article published in the Financial Times, Samuels expressed concern that patients were being starved of key medicines while the NHS was at risk of losing billions of pounds of vital savings. He highlighted chronic shortages of drugs used to treat conditions such as diabetes, Parkinson's, ADHD, asthma, multiple sclerosis, hormone replacement therapy and tuberculosis, as well as antibiotics, which are at record highs. "Politicians must commit to an industrial strategy that encourages manufacturing, addresses regulatory delays and provides manufacturers with the certainty they need to return the UK to priority supply markets," he said. According to the UK Generic Manufacturers Association, drug shortages in the UK have doubled in the past two years, with 101 reported drug supply problems in February 2024, compared to 52 in February 2022.

Lindmik Pharmaceutical(Suzhou)Co.,Ltd is a high-tech pharmaceutical enterprise focusing on the research and development, production and sales of innovative pharmaceutical preparations.Equipped with a number of its own innovative R&D platform of dosage forms, including the transdermal drug delivery system, and at the same time, actively introducing the world’s leading nano-based drug delivery, microspheres drug delivery and other cutting-edge pharmaceutical technologies by means of “license in”, the company is a new rapidly developing company pharmaceutical companies that catches people’s eyes.

12th Floor, Building 5, Tianyun Plaza, 111 Wusongjiang Avenue, Guoxiang Street, Wuzhong District, Suzhou City

0512-66020899

0512-66022699

215124